Yesterday was a very low-volume day across the board. A few stocks worked while the leaders were peacefully digesting the gains they made for weeks. Surprisingly, a lot of junk has also started moving up which was a scenario post-Covid. A lot of reversal plays are working well. The stocks low on relative strength that were underperforming for a very long have taken the baton from the stronger names.

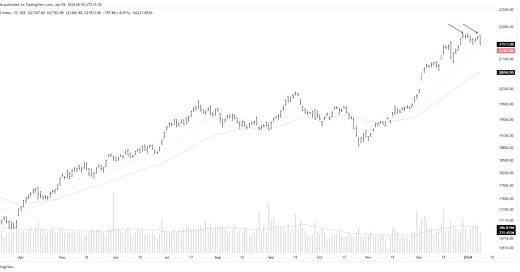

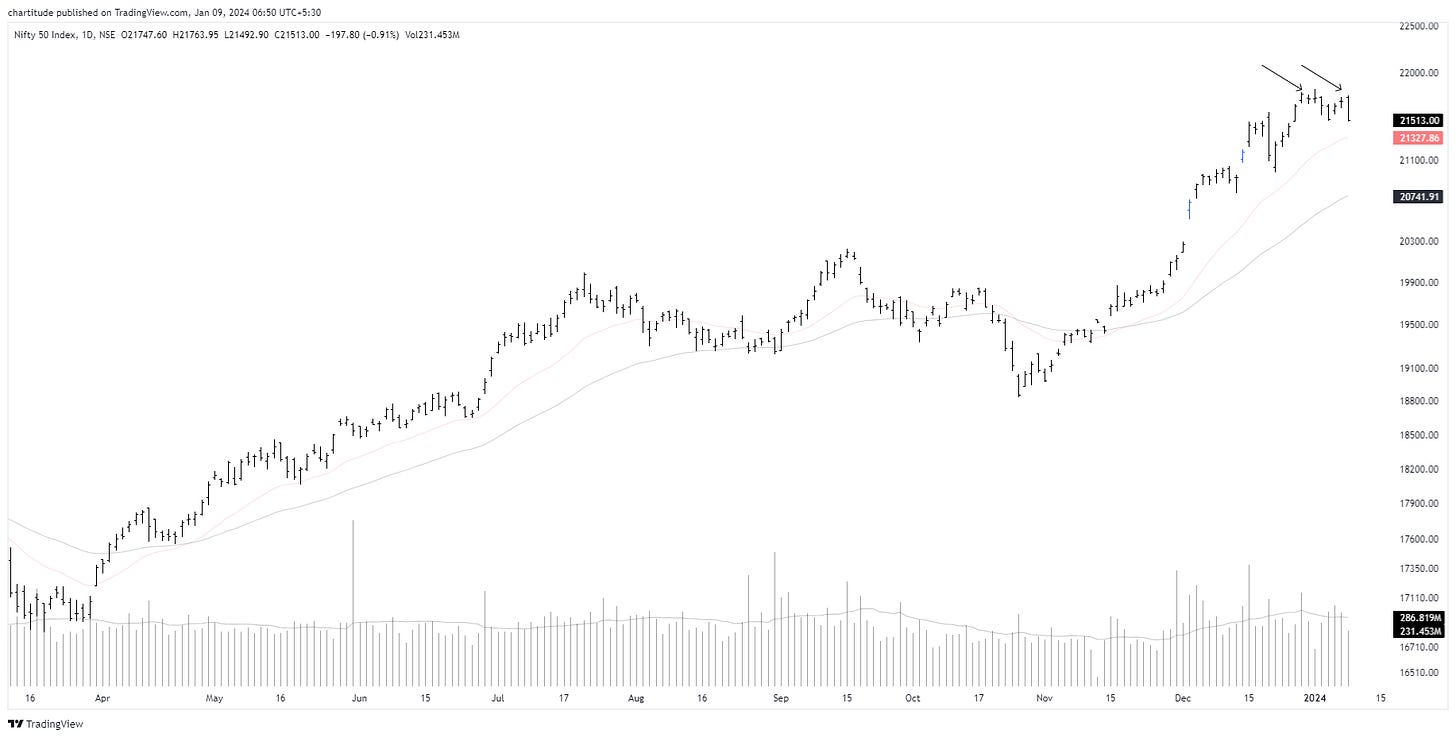

Last time, we discussed how the main index Nifty 50 is forming a series of higher highs and lows. This week, the index was unable to close above the swing high and fell back thereby marking 21800-850 as a short-term resistance. In this scenario, let us see if the index can form a mini base here itself. Overall, my inclination of still to stay with large or mid-cap names or the franchise with higher than 20,000 cr m-cap.

In any fresh trade, I am keeping my stops tight near the day low to maintain a higher average gain-to-loss ratio. For instance, if the stop is 2% deep, the move of 10% justifies selling half to lock 2.5R at a minimum.

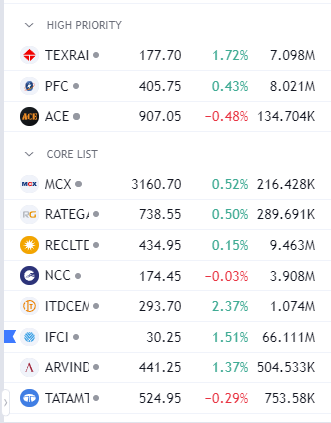

Some stocks that I am tracking closely for short-term trades are:

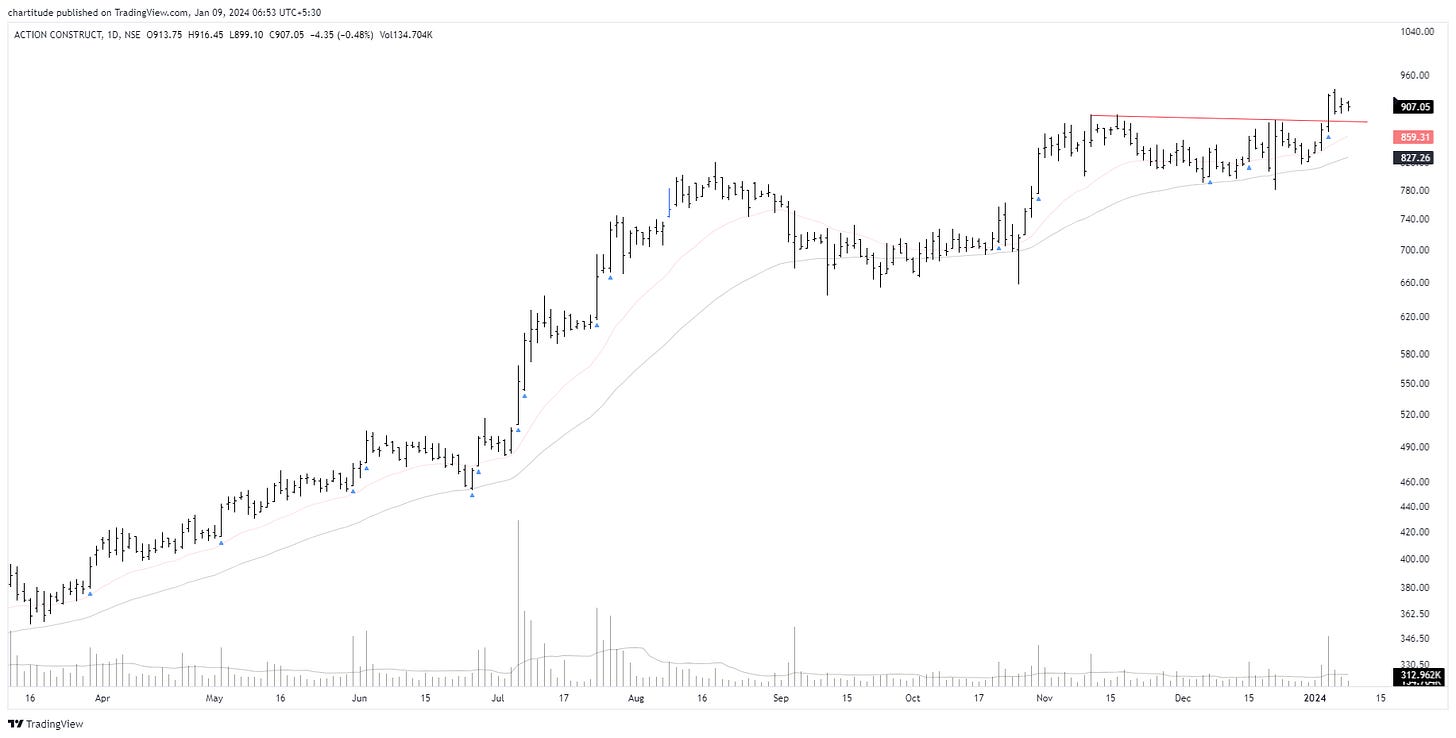

ACE: Immediately post the BO, the stock has shown some inside bars. The inside bar is when each subsequent bar is within the range of the previous bar. I intend to trade this if it moves to the upside. Do note that we always buy in the direction of the trend.

Texmaco Rail: I am looking for at least some sort of volume spike with the price moving up to add further to this name. As of now, it is just forming a mini base right post the BO

You should have a look at some of the charts that I have shortlisted. But, to be honest, today nothing stands out so far that my intuition says to pull the trigger. I will be on a wait-and-watch mode with either ACE giving me an entry or me just pyramiding up something that I already hold.

The list of high-priority names does change every day depending on how my watchlist stocks have performed. So, the list is just an example to show you the process that I follow. It may have altogether new names tomorrow.

To conclude, I am sitting in almost 50% cash as of now with a lot of stocks wherein I have locked a lot of my gains. Looking for longer base BOs in high relative strength stocks. The situation is that now many stocks are extended and a correction is pending. I hope we get good right-side development on many charts to play with a much higher probability than now. Until then, I am cautious to keep my equity curve near the highs.

Thanks. I will have more for later.

Very informative analysis.