TA Simplified: 26th Dec

Consider this newsletter as my own diary and not as a service for buy/sell recommendation

Good Morning

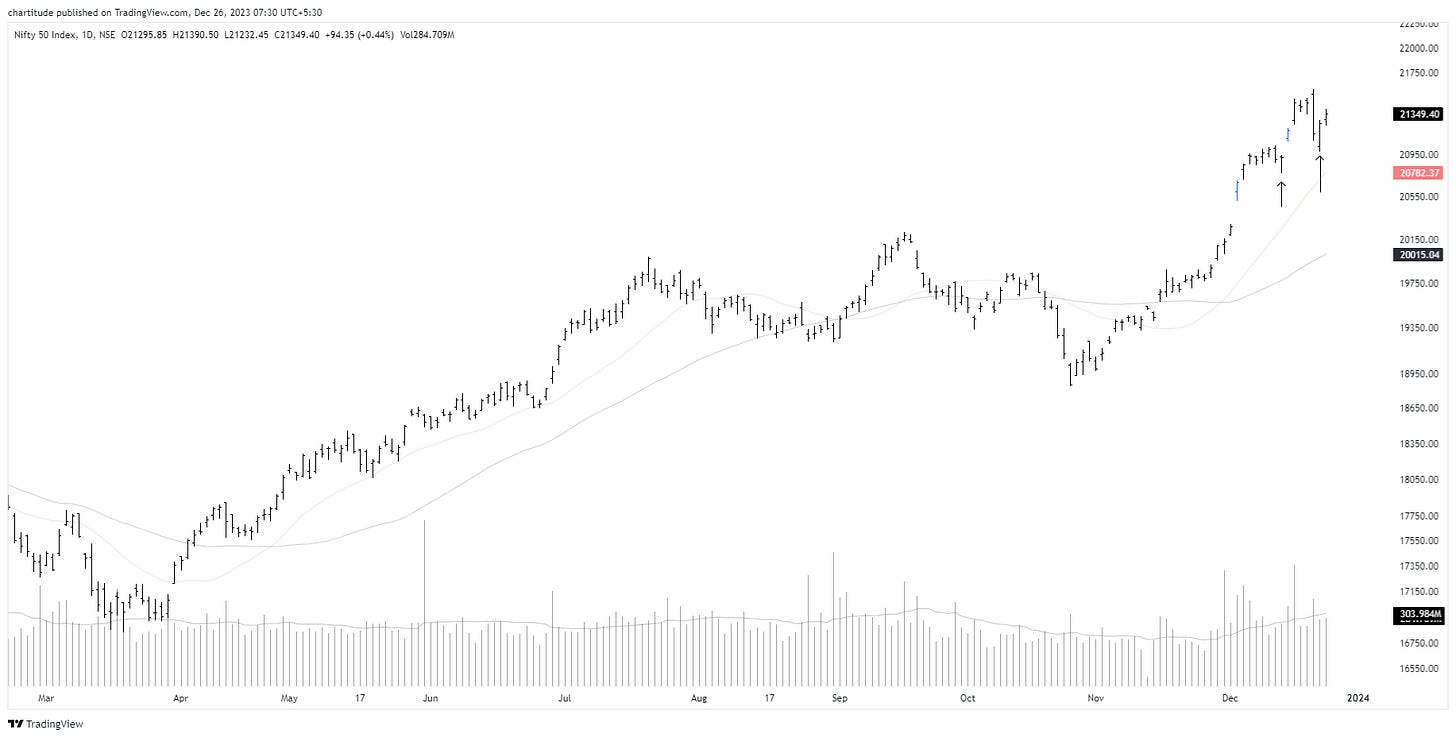

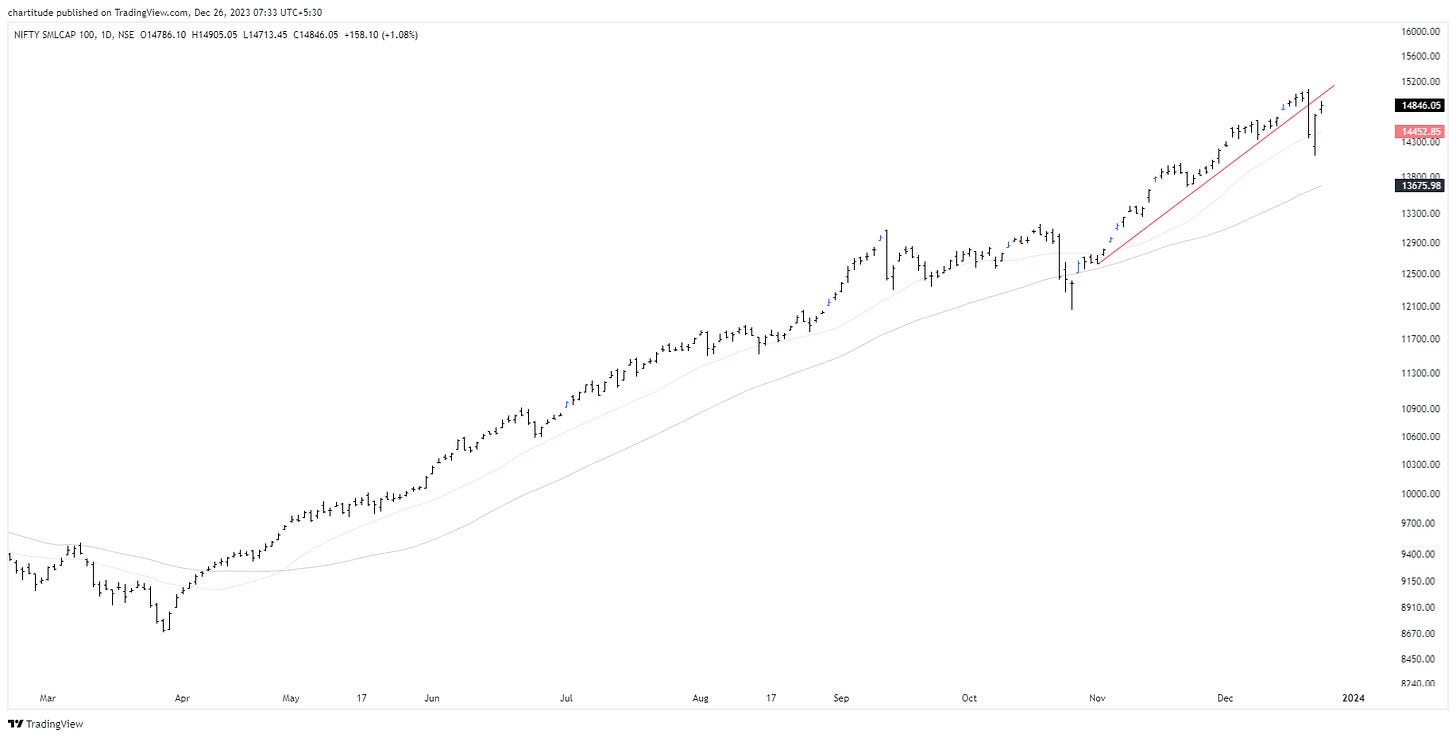

Only if you remember, we discussed how the small caps were stalling or underperforming vis-a-vis the large caps in our previous letter. This past week, we saw a one-day fall wherein most of the stops were triggered while the major index Nifty withstood the pressure. Let us have a look at the indices:

Nifty 50: Only if you recall we discussed how the Nifty is in a stronger shape and unless the previous black arrow is breached, we are comfortable with whatever it does near this level. We have yet another higher swing low which indicates that it is still in an uptrend. Therefore, I mentioned before that I am mostly placing my bets around large/mid-caps (companies with more than 20,000 crore m-cap)

Nifty Small-cap: we have breached this sloping trendline with force. I don’t rule out a pullback to the zone of 15000-100 which is quite normal. What I intend to see is the reaction of the price after reaching that zone which is a resistance area. It is better if it consolidates around that area before any further moves to the upside. I am not saying there are not many stocks that are not acting right, but, being a trader - it becomes too important to focus more on your account and preserving your gains when the market is enjoying a gala time with this parabolic tide. We will be clear in a couple of weeks. Now, with this as a template - you can analyze the same for the Mid-cap index yourself. Try if you can do the same. We are here to learn how to fish.

Some of the large/mid-cap names I am stalking are:

$CHOLAFIN

$TITAN

$ITC is beautifully respecting its 21-EMA and has bounced back from the same zone. With the lesser risk it offers, I might take a bigger position in this name.

Mazdock: I have this name on my list but I am as of now not too convinced about this. the way it reacted after positive news tells me to buy this in a conservative mode. That is, to wait for a clean move and add a bit late

I think in the last few letters I mentioned about 3M India and Bayer CropScience. You can now check their charts for learning.

I have some other names also that I am checking for today but they all are somewhat choppy and I do not intend to dip in my toes while sipping a wine peacefully at the corner. My equity curve is near the peak and I am too conservative to give back even a bit of my gains. I built two positions last week taking 0.25% risk of the total capital which is minuscule - APAR and LT

In case you intend to know those other names, here they are: Play at your own risk.

Next letter - hopefully the conditions will be clear and I will have more to write as I am back from the Jaipur meetup utilising part of my gains for the trip :)

Thanks and I will be back again….

excellent article, thanks. this format is better than Twitter for explanatory notes.

Thanks that's help to learn risk management and trading phycology